Petco CEO said the company was less affected by inflation and price changes in the higher pet stock market. While this may be true, the fact is that the company did not perform as well as the competitors below. The higher part of the pet supply market has become more diverse. The pandemic and the Internet have helped make the all-channel experience even more important in successful retail. That’s why the company’s strategy has worked so well so far.

Inflation has affected Petca’s sales, and the company is increasingly focusing on digital transformation. While its U.S. stores continue to grow, Chewy is growing faster. Petco’s revenue rose 15% in the third quarter, including 21% for consumer products and services, while Chewy grew 28% due to its subscription program and membership-based sales.

Growth in the pet food category is a concern for Petco. However, pet owners have been flocking to online stores for the past few years. This trend is likely to continue as long as consumers continue to use their credit cards to care for pets. The company is investing heavily in all-channel capacity, and recently introduced a roadside pickup. These investments should help the company keep up with the growing demand for pets.

Inflation and changing product offerings are a constant struggle for every retailer. However, one of the key factors affecting a company is the size of the US market. Petco is the second largest in the country with more than 1,449 pet care center locations in the United States. Its joint venture with Mexico has 108 locations and an online presence. While the U.S. retail industry is growing slowly, Chewy is growing much faster than Petco.

Despite the underlying challenges of the U.S. pet market, the company continues to grow faster than most competitors, including Chewy. The retailer recorded a 15% increase in revenue in the third quarter, mainly from services and consumer products, and Chewy recorded a twofold increase in revenue due to its subscription programs. This trend is not surprising, as pet adoption continues to grow.

The company’s growth path remains strong despite the current pandemic. Inflation and changes in the product offer have proven to be a major obstacle for the company in the last two years. In addition, Chewy has been growing faster than Petco in the last two years. The two companies also have joint ventures in Mexico. In the third quarter, the U.S. company reported a 15 percent increase in total revenue from its services and products. The growth was driven by an increase in the number of pet households.

The company’s growth forecasts for the second quarter reflect the fact that it is a multi-channel retailer. Its 1,449 U.S. pet care centers offer a wide variety of products in addition to 108 locations in Mexico. In addition to a high-quality food selection, the store offers delivery, pick-up at the edge and excellent customer service.

Petco’s growth prospects are largely supported by strong adoptions. The company’s new pets will grow to more than £ 100 in one year. These larger pets will consume more food. Therefore, the company’s sales in this category will decrease in the first year. By the second year, the company’s revenue will increase, but the cost of goods and services will remain unchanged.

The company’s sales continued to increase. The company increased the LTV of its products by more than 30% in the third quarter. LTV companies are only shy than LTV dogs and are more affordable, making the company more attractive to consumers. His online store is present in Mexico. Compared to other businesses, it is also a better place for retailers to invest in capacity from the web to offline.

Erik Gonzalez Garcia / iStock Editorial via Getty Images

Erik Gonzalez Garcia / iStock Editorial via Getty Images

Contents

A Quick Take On Petco

Petco Health and Wellness (NASDAQ: WOOF) went public in January 2021 and raised about $ 817 million in gross proceeds with an IPO, valued at $ 18.00 per share, and the company estimated it at about $ 4 billion.

The company sells pet-related products and services online and offline through its retail network and website.

Until the company is able to achieve significant volume and growth in retail store activities alone, for example through its veterinary / health / care initiatives, WOOF seems to be stuck in a paradigm of slower growth compared to competitors only online.

For Petco, I am neutral on waiting until he shows a higher path of growth.

Company

Petco, based in San Diego, California, was founded in 1965 as a specialized retailer to offer pet owners products and services to improve the quality of life of their pets.

The company has since expanded to provide online access to products and services through its website and mobile app.

The management is led by CEO Ron Coughlin, who has been with the company since 2018 and was previously chairman of HP’s personal systems business.

Petco’s Customer Acquisition

The company is gaining customers and users through its network of offline retail stores with approximately 1,449 pet care center locations in the U.S. and Puerto Rico, as well as through online social media, SEO and advertising. The company also has a joint venture in Mexico with 108 locations and an online presence there.

In recent years, Petco has invested heavily in building its capacity from the Internet to offline, enabling customers to shop and pick up online at the [BOPUS] store and pick up by the roadside.

Management believes that its multi-channel approach leads to increased customer retention and higher spending per customer.

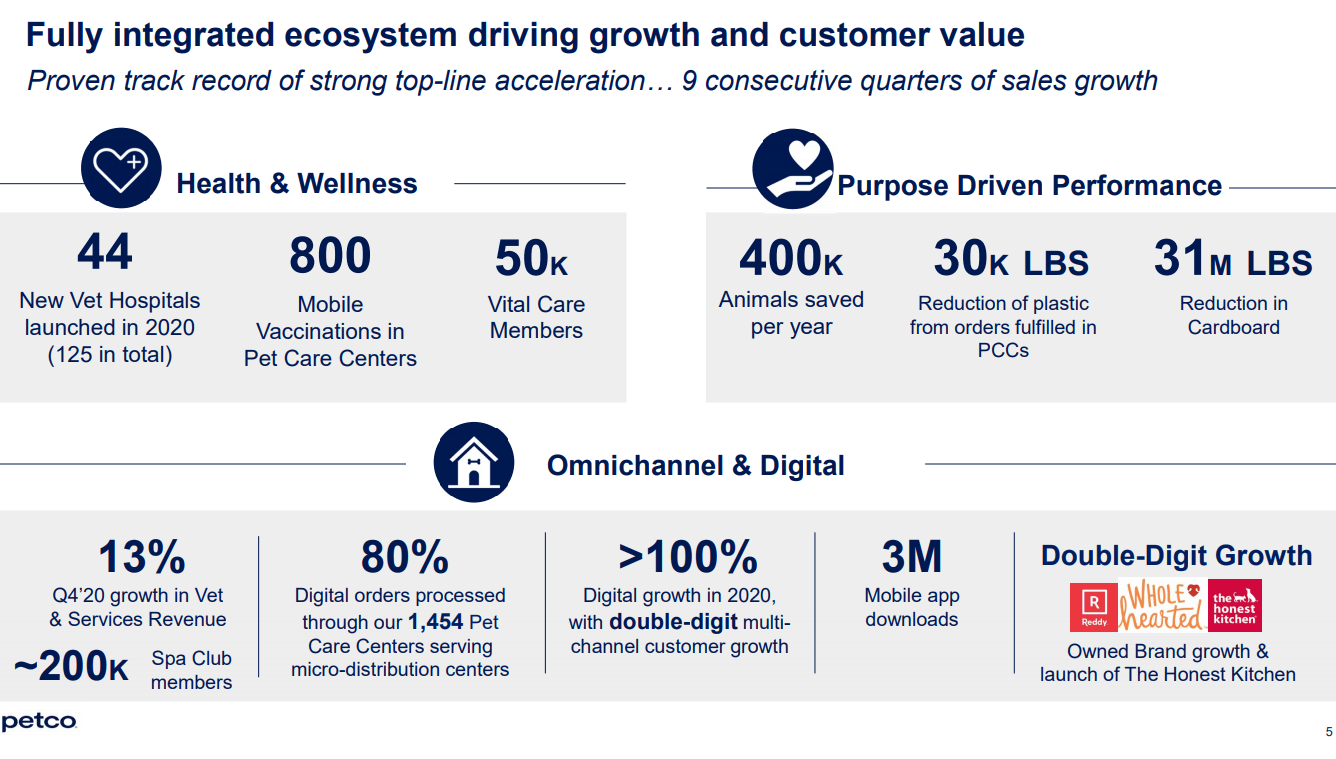

Below is a graph showing how the company sees its ecosystem:

Petco’s Market & Competition

According to the 2018 Grand View Research market research report, the global market for pet care products and services was $ 131.7 billion in 2016 and is expected to exceed $ 202 billion by 2025.

This represents a CAGR forecast of 4.9% from 2016 to 2025.

The main drivers of this expected growth are increased innovation in products and services by market participants and increased use of technology for tracking and caring for pets.

Also, more and more different technology solutions are attracting and retaining pet owners in sticky service apps like Wag and DogVacay.

Major competitors or other actors in the industry include:

Other major and local retailers online / offline

WOOF’s Recent Financial Performance

Heat revenues by quarters have grown successively over the last 5 quarters:

5-quarter total revenue (Seeking Alpha and The Author)

5-quarter total revenue (Seeking Alpha and The Author)

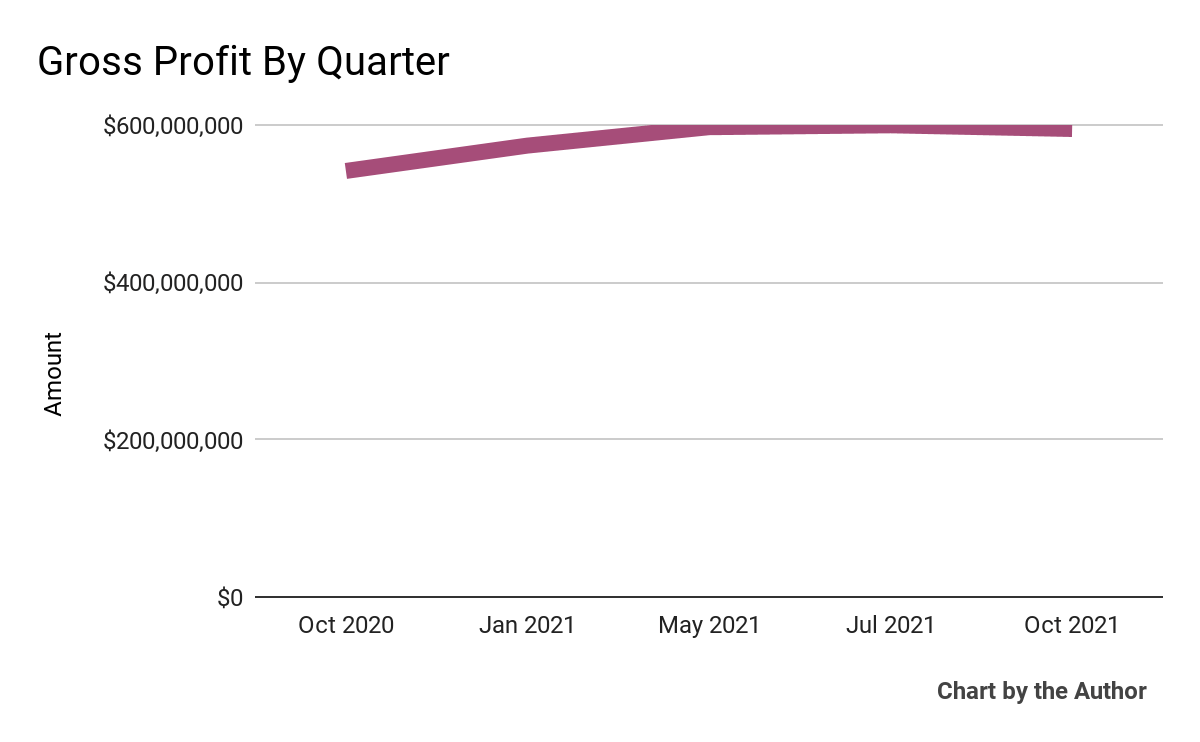

Gross profit after the quarter followed roughly the same path as total revenue:

5-quarter gross profit (Seeking Alpha and The Author)

5-quarter gross profit (Seeking Alpha and The Author)

Revenues from continuing operations by quarters increased significantly in the 3rd and 4th half of 2021:

5-Quarter Operating Income (Seeking Alpha and The Author)

5-Quarter Operating Income (Seeking Alpha and The Author)

Earnings per share (diluted) followed a similar path as operating income:

5-quarter earnings per share (Seeking Alpha and The Author)

5-quarter earnings per share (Seeking Alpha and The Author)

(Source data for GAAP financial charts above)

In the last 12 months, the price of the WOOF share has fallen by 23.4 percent compared to the growth of the US S&P 500 index by 13.65 percent, as shown in the chart below:

52-week share price (looking for alpha)

52-week share price (looking for alpha)

Valuation Metrics For WOOF

Below is a table of relevant capitalization and valuation numbers for the company:

Measure the amount of market capitalization $ 5,210,000,000 Company value $ 8,030,000,000 Price / Sales 0.88 Company value / Sales 1.43 Company value / EBITDA 16.95 Free cash flow [TTM] $ 183,420,000,000 $ 183,420 $ 183,420 $ income.

As a reference, a partially comparable Chewy public would be appropriate; a comparison of their primary measurement measurements is shown below:

Metric Chewy Petco Varianca Price / Sale 2.63 0.88 -66.5% Company Value / Sales 2.60 1.43 -45.0% Company Value / EBITDA 456.64 16.95 -96.3% Free Cash current [TTM] 0.40 e01% 202.40 0.01%%

Commentary On Petco

In its latest earnings call, which covered the results of the third quarter of 2021, management highlighted the inflationary environment for products and labor.

In particular, CEO Ron Coughlin said the company was less affected by inflation (which it can’t handle) because of its focus on the higher part of the pet stock market, which is usually less affected by price changes.

In the area of labor, the WOOF reported a 40% increase in pet care center applications in the third quarter compared to early 2021.

Coughlin believes successful retail is now firmly focused on the cross-channel experience and has been accelerated by a pandemic that provides Petco with the benefits of its online presence-linked retail network.

It’s a blow to pure game players like Chewy, which is growing faster than Petco, which the pandemic over the past two years has undoubtedly hampered in its retail footprint.

In terms of its financial results, revenues in the third quarter increased by 15% compared to the same period last year and increased successively, with consumer products increasing by 21% year on year.

Services and other grew by 28% due to the growth of membership and subscription programs.

The company experienced inflationary pressures due to increased transport, logistics and labor costs, reducing its gross margin to 41.2%, which is 177 basis points. But management said that ‘on a consistent basis, the shift in gross margin was mainly driven by the excessive power of consumables’, which affects its product offering.

Free cash flow was $ 124 million, an 18% increase over the previous year, and its net leverage rate fell 19%, from 3.2x to 2.6x.

Looking ahead, management led the fourth quarter slightly higher than the third quarter after major measurements, although gross margins are expected to be consistent due to the aforementioned business power of consumables affecting product offering.

In terms of valuation, the market values WOOF at significantly lower valuation multiples than Chewy. In terms of revenue growth, this valuation difference seems valid as WOOF grows more slowly.

The main risk for the company’s prospects is the continuation of the inflationary environment for stocks and the labor force, although in recent months there have been signs of a larger movement of unemployed jobseekers.

While management says it has been able to withstand price increases because of its focus on higher-end customers, I wonder if it will continue to be so as long as inflation persists.

Another risk is increased sales of consumables, which lowers margins compared to other products.

The company says increasing consumables is a strategic advantage as it creates a higher lifetime value for the customer [LTV] compared to other stocks alone.

Although I like Petco’s all-channel performance, I still think the company may be on the slow-growing side of the debate just about the web compared to multi-channel.

Until the company can achieve significant volume and growth in retail store activities alone, for example through its veterinary / health / care initiatives, WOOF seems to be stuck in a paradigm of slower growth compared to competitors only online.

For Petca, I am on hold until he shows a higher path of growth.